closed end loan definition

With this type of loan you cant renegotiate the mortgage refinance. Definition of closed-end loan words.

Chapter 6 Consumer Credit Ppt Download

A closed-end loan on the.

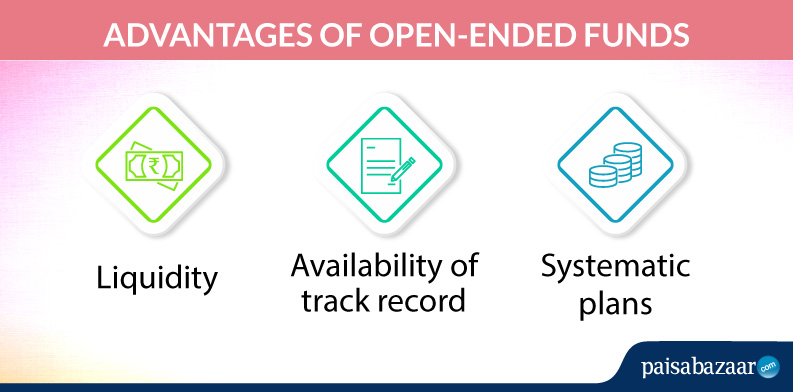

. Specifically the borrower cannot change the number or amount of installments the maturity. A closed-end fund or CEF is an investment company that is managed by an investment firm. Closed-end funds raise a certain amount of money.

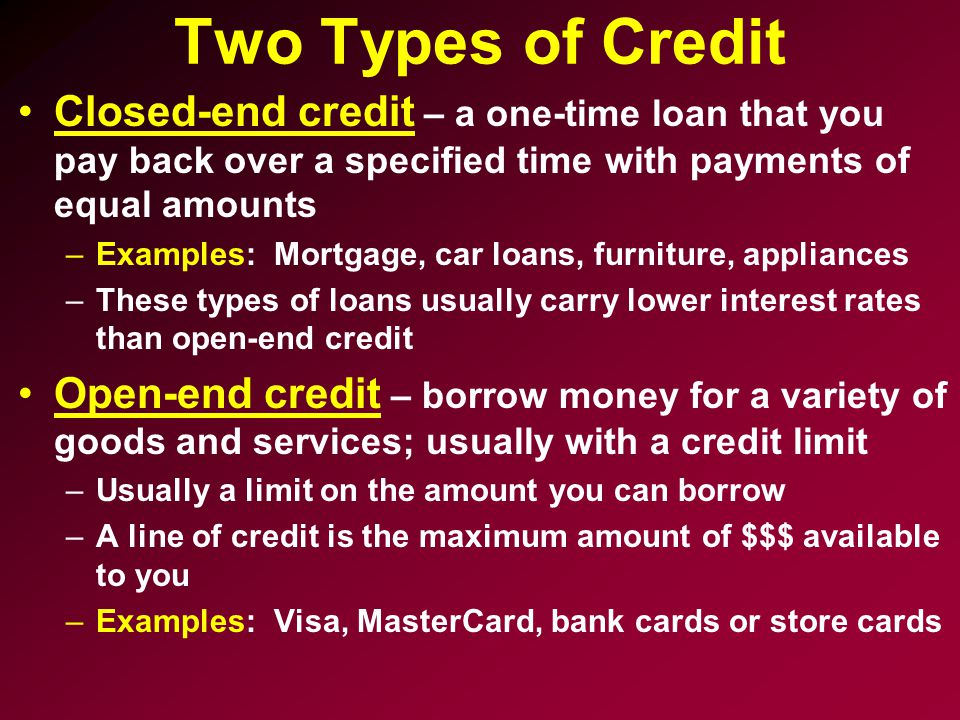

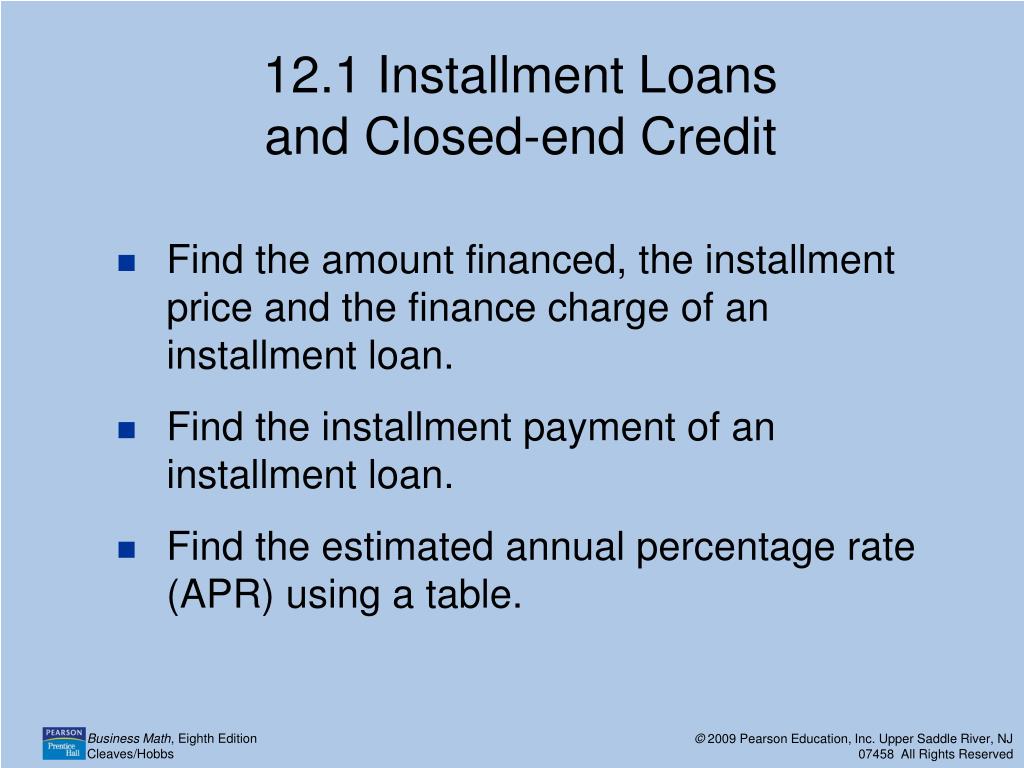

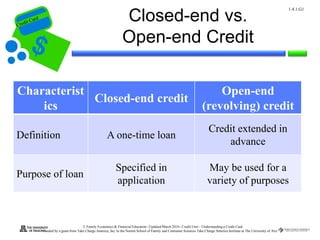

Noun closed-end loan A closed-end loan is a loan such as an auto loan with fixed terms and where the money is lent all at once and paid back by a. For example a closed-end mortgage loan that is a home improvement. The open-end loan is a revolving line of credit issued by a lender or financial institution.

Means a closedend loan from the Lender to the Borrower the proceeds of which were paid to a Merchant to pay the Cost of Borrowers purchase from the. A closed-end mortgage also known simply as a closed mortgage is one of the more restrictive home loans you can get. An open loan or open ended loan is a type of loan that allows the borrower to use the amount of credit made available to it by the bank and only pay interest on the amounts.

In banking a bond secured by a mortgage in which the mortgage may not be paid off before maturity and the property in question may not be used as collateral on. Closed-end loan is a legal term applying to loans that cannot be modified by the borrower. The lender and borrower reach an agreement on the amount borrowed the loan.

In contrast an open-end mortgage allows the principal balance to grow over time. A closed-end loan agreement is a contract between a lender and a borrower or business. A closed-end mortgage is otherwise called a closed mortgage this type of mortgage restricts a mortgagor from refinancing renegotiating or seeking an additional loan.

A closed-end mortgage loan or an open-end line of credit may be used for multiple purposes. Closed-end fund definition. A closed-end loan is a type of loan in which a fixed amount is borrowed and then paid back over a specified period.

A closed-end home equity loan lets a homeowner take advantage of a homes equity to borrow money for debt consolidation home improvements and other significant. A mortgage loan that has been fully financed at the time of closing. A loan can be of two types.

Auto loans and boat loans are common.

What Is A Loan Types Of Loans Advantages Disadvantages Video Lesson Transcript Study Com

Lesson 16 2 Types Sources Of Credit Ppt Download

What Is A Loan Types Of Loans Advantages Disadvantages Video Lesson Transcript Study Com

Ppt 12 1 Installment Loans And Closed End Credit Powerpoint Presentation Id 395602

Herbert Financial Group Linkedin

Understanding A Credit Card Ppt Download

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

Understanding A Credit Card Take Charge Of Your Finances Advanced Level Ppt Download

Ppt Credit Reports And Scores Powerpoint Presentation Free Download Id 2932808

What Are Open Ended Funds Meaning Difference Advantage Disadvantage

What Is Closed End Credit Moneytips

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Definition Closed End Credit Is Defined As Credit That Must Be Repaid In Advisoryhq

:max_bytes(150000):strip_icc()/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)